Making a Budget - Old School

If you have ever seen any financial guru on YouTube, the television, Twitter, or TikTok, they all advise to make a budget. It sounds wonderful in practice, but it can turn out to be a daunting task. Where do you even start? Do I need some facncy accounting software? Where the heck do I find that?

In this article, we will go over an old school budget approach that is spread out over many many months. Of course you can always condense this down as you see fit, but often times it’s easier to take things in small little pieces. Tackling a budget as an incremental process is much better than never picking up the task in the first place.

Why Make a Budget

Why make a budget? If the financial gurus haven’t convinced you, let me tell you it can add to peace of mind. Knowing where you stand financially can really give yourself a positive mental boost. Can I afford this thing I want to spend money on? I really want to take this trip, but do I have the money? How am I expected to save anything?

A budget can help you get there.

Budget Roadblocks

The road to creating a budget can be filled with roadblocks. Those roadblocks can be broken down however may different ways. View making a budget as if you are an explorer. Where the heck does my money go anyway? How much does my food really cost?

Breaking Down the Steps

As mentioned above, we are going to start small for our budget plan. Over time we are slowly going to add steps to our budget to get better and better. Even if you start with only a single small step, you have gone a long way to knowning your personal financial situation, which can lead to greater stability and happiness.

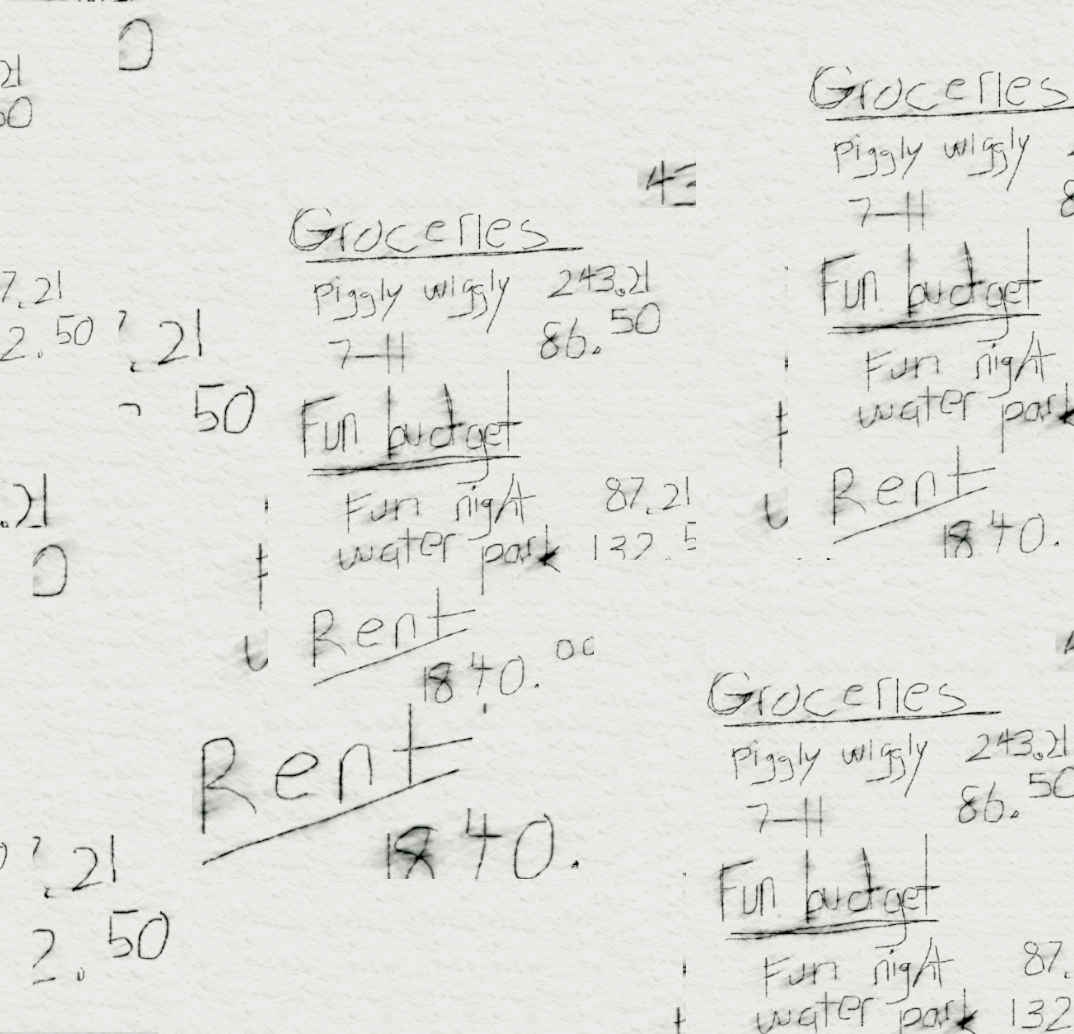

Month 1 - Categorize

For the first month, it’s going to be simple. We want to gather categories for your spending. This is going to be different for everyone. We are all at different stages of life and have different situations.

Grab a sheet of paper, and mark it categories. As you spend on things this month, write it down. Start grouping things together. Food might seem obvious, but there could be food you cook at home, going out, etc. I tend to classify food that I buy when out as entertainment.

Here are some general categories I use:

- Food

- Utilities

- Entertainment

- Housing

- Health

- Transportation

I wouldn’t recommend having a large amount of categories. Fixed expenses could also be broken out into their own categories. You can’t really change your rent or mortgage unless you move. For the point of a budget, it’s nice to see those things, but we want to be able to handle expenses we have immediate control over.

Month 2 - Collect and Categorize

OK, so you have your categories setup. Now it’s time to start writing things down. Get a fresh pad of paper, electronic notebook, whatever you want — and write down everything you spend. I mean everything. Put it within those categories you wrote down before.

End of the month

Whew. I hope you wrote everything down. It’s time to add it all up for each category. After you have added up each category, draw a nice box around each one, and add it to a total.

Now take the money you earn from whatever jobs you have, and subtract all of those expenses.

Hopefully you came out with some money left over. If you didn’t, this is where we need to pay special attention to our next steps.

Month 3 - Define Your Budget

Now it’s time to assess, and define an actual budget. Did you spend a thousand dollars going out to nightclubs? Did you overspend on movie popcorn every weekend? There are endless possibilities of where to spend your money.

Take the time to baseline each category. For instance, if your food budget was 800 dollars, figure out if that is reasonable, or you want to raise or lower it. Do that for every category.

Now add all those up and subtract them from your regular income.

Make adjustments.

And more adjustments.

When you are happy of where you can spend in each category, for the next month, add as you spend.

Month 4 - Spend within the Limit

Now it’s really time to track based on the limits you have set for yourself. If you have already gone out 5 times this week, and you are at your “fun budget” spending amount, maybe it’s time to stay in.

Month 6 - Narrow the window

If you have gotten this far, it might be useful to narrow your budget down to a shorter window, such as every two weeks, or simply align with when you get paid. Making a shorter window will make it easier to track and add up all of your expenditures.

Conclusion

To sum it all up, the low-tech fast budget approach involves:

- Look at your spending and make some categories.

- Start tracking your spending and add up the amounts in each category.

- Make a budget and make sure you are spending less than you make.

- Narrow the time frame for your budget to make it easier to track.

After that’s all done, and you are on a roll, the next major item is to add a budget item for saving!